The Broker Time Cookie

Gesturing toward the chocolate chip cookie on a plate before us, she said, “I call this my time-cookie and it represents my life.” Sitting in a corner booth of a Panera Bread in Florida, I was meeting with a real estate Broker/Owner whom I’ll call Susan.

She looked around, lowered her voice and continued. “Every year my time-cookie keeps getting smaller and smaller.” Susan broke off  a small piece of the cookie, gently shook it toward me and said, “this is time I spend working on getting deals done.” She popped the piece in her mouth and broke off another. “This piece is the time I spend on working with other brokers and agents and solving problems.”

a small piece of the cookie, gently shook it toward me and said, “this is time I spend working on getting deals done.” She popped the piece in her mouth and broke off another. “This piece is the time I spend on working with other brokers and agents and solving problems.”

She slowly chewed a moment in thoughtful silence before taking a bigger piece. “Then there’s the whole technology thing, the website, social media and getting leads.” She laughed softly, the next bite represented “keeping up with industry changes, my local board, and the constant phone interruptions.”

Now, the cookie was getting small. She stared at it a moment before picking it up, breaking most of it off and speaking slowly and very deliberately; almost painfully said, “here.. are.. the.. ‘gotta-minutes’… those constant interruptions that happen all day long when everyone brings me their problems to solve.” She shook her head and looked out the window and softly said, “and I have my own clients and deals to take care of too, all while trying to run a business.”

By now all that was left was crumbs. Looking at what was left, she swept the crumbs to one side of the plate with her hand slowly and dramatically and said “this is what is left of my time-cookie for me and for my family.”

Susan looked out the window in silence. The frustration showed on her face. After perhaps a minute she added, “but I love my agents, my clients and the real estate business. It’s just the day-to-day of running the business that make it not so much fun for me anymore.”

Fast forward four years. Susan and I were having coffee at the same Panera Bread and catching up. I had helped her merge her company with a larger brokerage that provided her an opportunity to get her “time cookie” back. The day-to-day activities that had gotten old were lifted off her shoulders and she could focus on the parts of the business she enjoyed and that had made her successful through the years. Her agents were provided with tools and resources that helped them significantly grow their businesses and incomes. She now shares financially in the growth of the merged companies.

Today, Susan enjoys more free time, travels regularly and enjoys her family as she excitedly awaits her first grandchild. She also chooses the transactions she wants to work on, makes considerably more money and has financially prepared for her future.

As we chatted I placed a single chocolate chip cookie in front of her. She laughed and said, “you remembered!”

For many brokers there often comes a time when getting a life back is appealing. There are options, whether it’s selling your brokerage, exploring merger opportunities or investigating how affiliating with a major brand can provide opportunities and resources that can be life-changing.

Get More Time Back: Contact Rick Today ”

Is the U.S. Housing Market

Poised for a Correction?

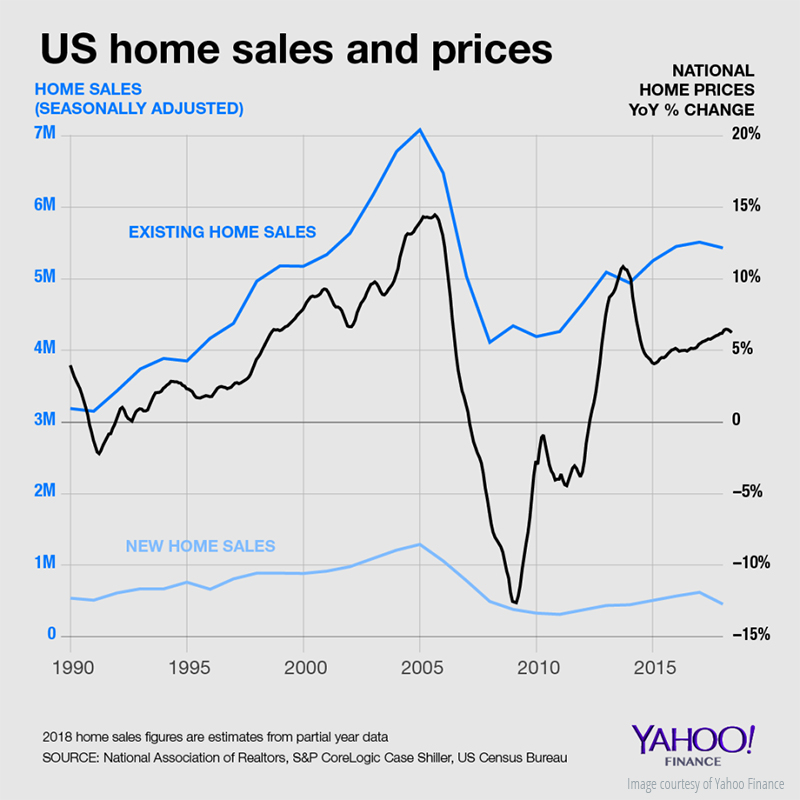

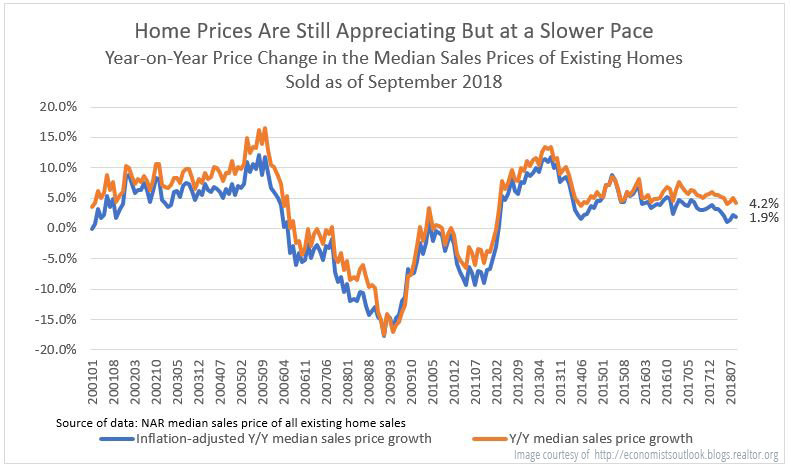

Recently, the S&P CoreLogic Case-Shiller national home price index reported a 5.8% annual gain in August, down from 6% in the previous month – the first time in a year that annual gains fell below 6%. The home price figures followed a decline in existing and new home sales.

“The housing market has a momentum problem,” said Shiller.

“We’re seeing a clipping of momentum at this time.”

The momentum started to noticeably lose steam in July. Economists have already called a peak of certain housing market indicators and adjusted their forecasts downward. During the Great Recession, home prices fell by as much as 35% in some markets and plummeted at an annual rate of 4%. Some are beginning to wonder if prices will suffer the same fate this time around.

Read the full story on Yahoo Finance.

Future Watch: Blockchain, iBuying, and Venture Capitalism

The real estate industry continues to evolve. The entire process of how homes are bought and sold, as well as how and what to pay for those home, is changing daily. The effect on the real estate industry is happening so rapidly that most of these trends are just now taking hold.

For instance, iBuying is expanding as investors offer quick-close offers to home sellers, and then turn it around and immediately relist the property. Recently, an iBuyer startup received $250M with the promise of an additional $1B; and a prefab home manufacturer raised $6.7M in series A funding within a week from Amazon and others.

Early-stage venture capital funds are investing in startups all over the industry, and some of them include blockchain-related solutions to help make the transaction process easier and more secure. The entire ecosystem that supports the real estate transaction is being forever altered by advances in tech.

Brokerage consolidation is becoming the new normal as mergers and acquisitions of well-known, established brokerages like Allen Tate and Ebby Halliday are acquired. Independents continue to face mounting headwinds of going it alone as larger real estate companies continue to make the game-changing technology investments necessary to win.

The future is not as far away as you think. Don’t be left behind.

Market Snapshot

With interest rates rising and house price appreciation slowing down or depreciating in some metro areas, it is worth recalling the conditions that prevailed prior to the housing market’s downturn in 2005 and to compare these with current market conditions.

First, housing supply is tighter. Supply conditions are tighter today than they were in 2004. In January 2004, there were 1.9 million housing units under construction, or 700 thousand more housing starts compared to August 2018.

Second, households were more indebted and credit quality was lower, making them more vulnerable to rising interest rates and depreciating home prices. Mortgage debt accounted for 81 percent of disposable income in the first quarter of 2004 compared to only 66 percent in 2018.

Third, the economy is stronger now than it is in the 2004 when interest rates started rising and home prices started falling as foreclosures rose. The unemployment rate stood at 3.7 percent in August 2018, the lowest since 1969 when the unemployment rate averaged 3.5 percent. A stronger economy bodes well for employment and reduces the risk of a housing market downturn.

Given the current economic, housing market, and credit conditions, it seems unlikely that prices will fall as steeply as they did during 2005 through 2012. To date, median sales price of existing homes sold has increased on a year-over-year basis for 79 consecutive months since March 2012. However, prices are appreciating at a slower pace compared to past months because the rising interest rates are making homes less affordable given the current level of home prices.

Read the full story on the NAR® Economist Blog