“When is the housing market going to crash” was a Google search topic that recently spiked by 2,450% among online consumers. It’s a subject that has been on the minds of many and a regular topic in industry discussions.

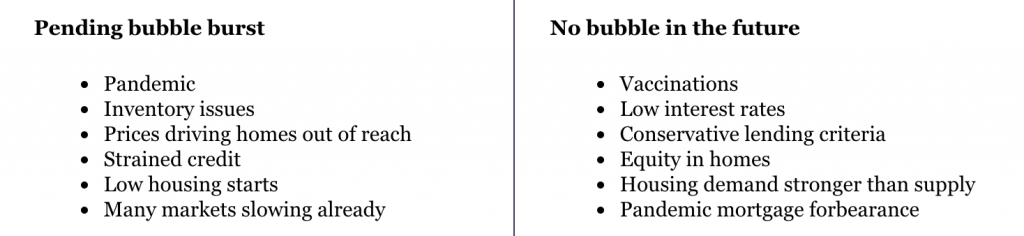

The real estate market has been white-hot this past year with more homes sold since 2006. It’s been fueled by a number of change factors, including the ability of many to work remotely from different geographic areas; some seeking more space; others choosing new locations based on lifestyle. However, there has been increasing concern among consumers that housing is experiencing a bubble – and that the bubble may be ready to burst. There are indicators that could make a strong case for either “yea” or “nay” to the pending bubble question.

Real estate has always been a cyclical business and at some point, a slowdown is imminent. Many markets are starting to see softening, fewer bidding wars and longer days on market. The degree of a slowdown is up for debate.

A driver of the market is the current pandemic and the question that’s been raging, “how do you get out of a pandemic?” This is a first for everyone in the U.S. but there are now positive trends as one-third of the U.S. is 100% vaccinated and almost another one third is at least partially vaccinated. In other regions, that’s not the case as there are various levels of vaccination in different countries. This means staggered economic recovery rates globally which will continue to impact the U.S. residential market especially in those areas that have high percentages of international real estate sales.

partially vaccinated. In other regions, that’s not the case as there are various levels of vaccination in different countries. This means staggered economic recovery rates globally which will continue to impact the U.S. residential market especially in those areas that have high percentages of international real estate sales.

Some areas of life are returning to normal. Air travel recently hit a single-day travel record since pre-COVID with 1.6 million people traveling on the Thursday before Mothers’ Day. However, progress is still lagging in travel segments such as availability of rental cars, hotel rooms, restaurant services, etc.

There are other significant issues. We are strongly impacted by unemployment, supply chain problems and certain industries struggling to find workers. In fact, the most recent jobs report missed expectations as not as many people returned to work as expected. The increase in wages continues to be significantly lower than the home price increases which has an increasingly negative industry impact.

Inventory is a critical factor driving the market. While the housing shortage is affected by the current moratorium on foreclosures, home builders are not keeping up with long-term demand growth. Housing starts have been impacted by the significant increase in costs, low supply of building materials and the lack of available workers. In February alone, new home sales decreased by 18%. Added to the inventory issues, many would-be sellers have held homes off the market as the pricing and availability of replacement homes restricts a reseller’s options to either move up or downsize.

On the positive side, some of the lingering issues will likely keep inflation and mortgage rates down for now. Inventory will continue to be problematic especially for smaller, independent brokers. The lack of new housing starts will drag the resale market out longer. Ironically, forbearance has served to keep the market from being flooded by foreclosed homes which would actually increase inventory and drive prices downward.

Expect to see a softening but not a crash. Unlike 2008, the risk factor in the mortgage market is much lower than the “Great Recession” when the industry took on unnecessary risk with sub-prime loans which brought down the market requiring the U.S. government to jump in and fix the issues. It took years for the industry to figure out and unwind the problems that plagued real estate. Today’s lenders are much more conservative than what was prevalent leading up to the crash.

A major difference in today’s housing market is that demand far exceeds the supply. Much of the real estate activity leading up to the 2008 crash was driven by speculators while today’s market is primarily driven by the owner/occupant.

A key difference today is that a high percentage of homeowners have significant equity in their homes which, according to CoreLogic, increased an average of $17,000 over the past year. This contrasts sharply with the Great Recession when many homeowners treated their home’s equity like the “piggy bank” and borrowed against it, ultimately fueling personal financial disaster.

A key difference today is that a high percentage of homeowners have significant equity in their homes which, according to CoreLogic, increased an average of $17,000 over the past year. This contrasts sharply with the Great Recession when many homeowners treated their home’s equity like the “piggy bank” and borrowed against it, ultimately fueling personal financial disaster.

I do believe the market will see-saw, but after so many people have quarantined at home, there is a huge demand for homeownership, and a return to demand for bigger houses. NAR still predicts a 2021 growth rate of 10% over last year.

Four things to follow:

- The stock market– At 34,000 the market is much higher now than the 27,000 level it was at with the start of the pandemic

- Interest rates- Hovering below 3% interest makes it much easier for people to move up

- Home equity – An estimated one-third of U.S. homes are “equity rich” meaning the mortgage is less than 50% of the home’s value and that number is climbing.

- Consumer spending- How is spending trending as we climb out of the pandemic?

As a broker, what’s ahead for you and your firm? If you would like to have a conversation about opportunities to scale, recruit or even plan an exit strategy, please reach out to me. We see a lot of opportunity right now.

Corcoran continues worldwide luxury growth

Corcoran is growing its luxury real estate brand through franchising. The name Corcoran is long synonymous with luxury real estate. Corcoran franchisees are affiliates. Fast forward to 2020 when Corcoran ventured into franchising the brand globally. In the last year, theCorcoran brand has grown into 21 markets with eleven affiliates from Hawaii to New York’s Hudson Valley and Westchester to California, Arizona, Nevada, Colorado, and Corcoran BVI (British Virgin Islands), Florida and New Jersey. Read more.

long synonymous with luxury real estate. Corcoran franchisees are affiliates. Fast forward to 2020 when Corcoran ventured into franchising the brand globally. In the last year, theCorcoran brand has grown into 21 markets with eleven affiliates from Hawaii to New York’s Hudson Valley and Westchester to California, Arizona, Nevada, Colorado, and Corcoran BVI (British Virgin Islands), Florida and New Jersey. Read more.

You made your good name. We can help make it stronger.

Corcoran is growing and we’re looking for a few good firms to grow with. Click here to learn about the Corcoran Network.

Foreclosure and eviction moratoriums ending- what’s next?

The pandemic-influenced moratorium on foreclosures will end in June, while millions of homeowners are also slated to exit their yearlong forbearance periods. According to the Mortgage Bankers Association, there are approximately 2.23 million affected homeowners. Landlords and property owners who have also been impacted are also expected to add to the inventory. See complete article.

The pandemic-influenced moratorium on foreclosures will end in June, while millions of homeowners are also slated to exit their yearlong forbearance periods. According to the Mortgage Bankers Association, there are approximately 2.23 million affected homeowners. Landlords and property owners who have also been impacted are also expected to add to the inventory. See complete article.

Compass sued for claims of defrauding agents

Compass defrauded its real estate agents out of millions of dollars in sales commissions and broke pledges to give agents shares of stock, according to a new lawsuit that seeks class-action status. Learn more.

Biden plan would end deferred capital-gains payments on sales

President Biden’s new economic plan would eliminate a tax break for many real-estate owners that has enabled them to defer paying capital gains on property sales. See more.